Self declaration of Individual Income Tax

Description

Taxpayers may make a declaration of individual income tax (IIT) by themselves in any of the following cases:

1. Taxpayers who obtain an annual income of 120,000 RMB or more (excluding those individuals who have no domicile within the territory of China and have resided within the territory of China for less than one year in a tax year) shall make declaration within 3 months after a tax year ends.

2. Taxpayers who obtain income from abroad (referring to individuals who have domicile within the territory of China or who have no domicile but have resided within the territory of China for less than one year in a tax year) shall make a declaration within 30 days after a tax year ends.

3. Taxpayers, who obtain wages and salaries from two or more sources within the territory of China, who obtain taxable income and there is no withholding agent, and who are under any other circumstances as prescribed by the State Council, shall make declaration within 15 days of the next month following obtaining taxable items calculated by month or by time.

4. Taxpayers, whose equities are transferred to any other individual or any legal entity, shall make declaration within the first 15 days of the following month.

5. Individual income tax on income from the transfer of restricted stock

(1) The IIT, levied by such ways as pre-withholding and prepayment by securities institutions, or self-filing and settlement by taxpayers, shall be pre-withheld and prepaid by securities institutions. If there is any discrepancy between taxable income, which is computed by a taxpayer on the basis of the actual transfer income and the actual cost, and the tax pre-withheld and prepaid by securities institution, the taxpayer shall handle the filing and settlement within 3 months as of the first day of the following month.

(2) Taxpayers who adopt self-declaration shall self-declare IIT on income from the transfer of restricted stock within the first 15 days of the following month, and handle all tax-related matters together.

6. Taxpayers shall file returns of and pay IIT on investments with personal non-monetary assets within the time limit for tax payment as agreed at the time of the recordation.

Submission

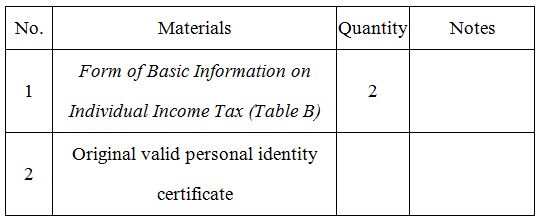

1. Taxpayers who firstly make declaration or change basic information shall submit:

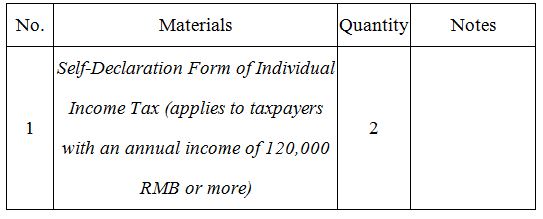

2. Taxpayers who obtain an annual income of 120,000 RMB or more shall submit:

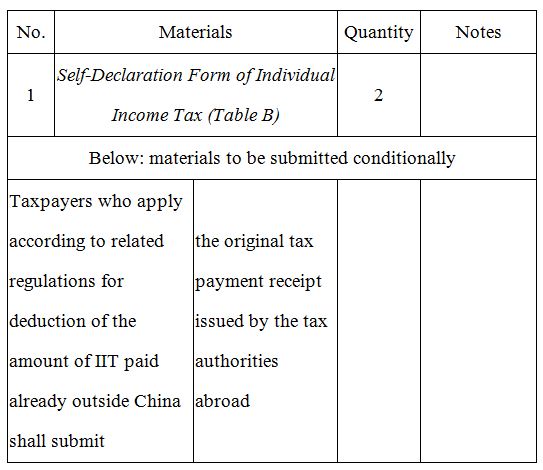

3. Taxpayers who obtain income from abroad shall submit:

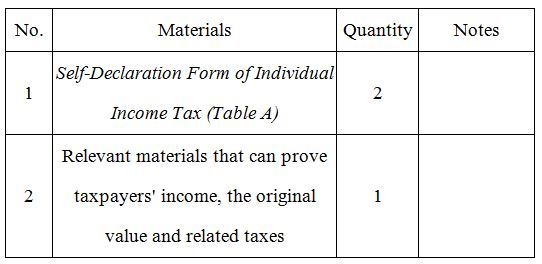

4. Taxpayers, who obtain wages and salaries from two or more sources within the territory of China, who obtain taxable income and there is no withholding agent, and who are under any other circumstances as prescribed by the State Council, shall submit:

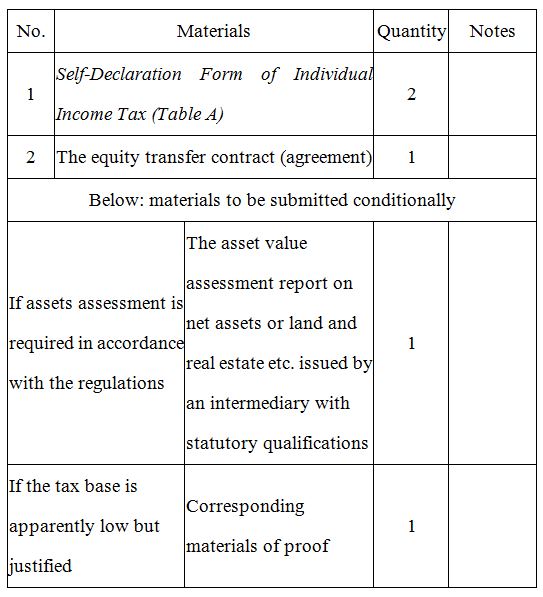

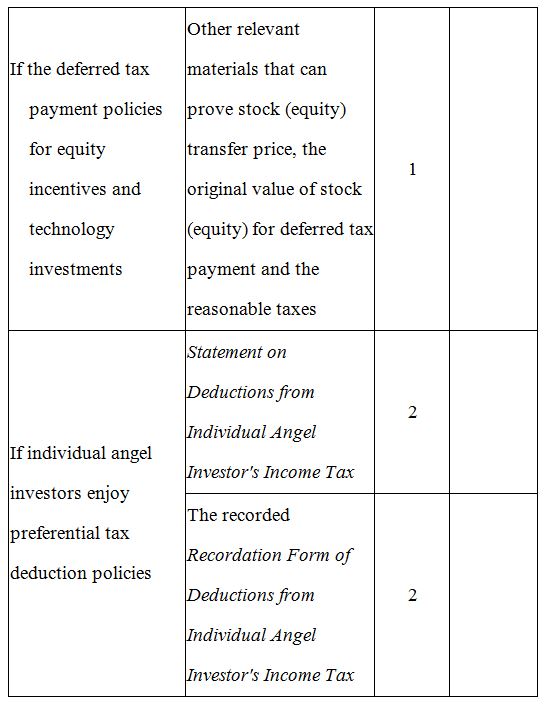

5. Taxpayers, whose equities are transferred to any other individual or any legal entity under circumstances as prescribed in the Measures for the Administration of Individual Income Tax on Equity Transfer Income (for Trial Implementation), shall submit:

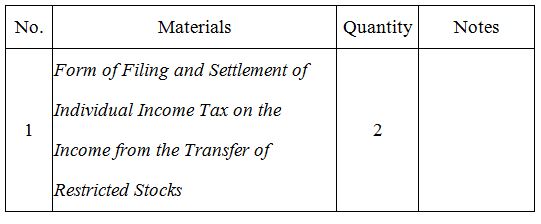

6. Individual income tax on incomes from the transfer of restricted stock

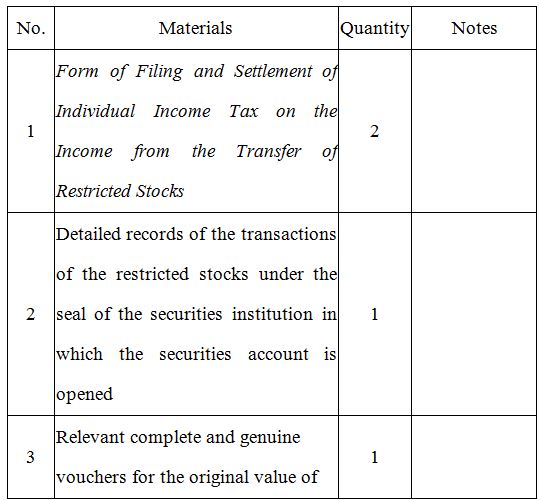

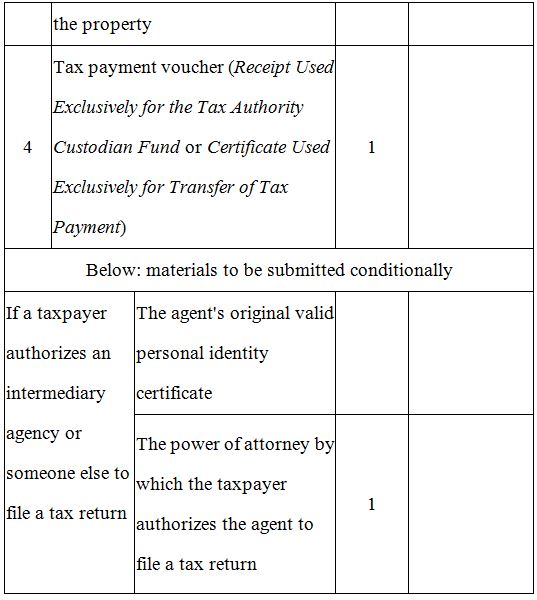

(1) Taxpayers, whose IIT are levied by such ways as pre-withholding and prepayment by securities institutions, filing and settlement by taxpayers themselves, shall submit:

(2) Taxpayers who adopt the self-declaration way shall submit:

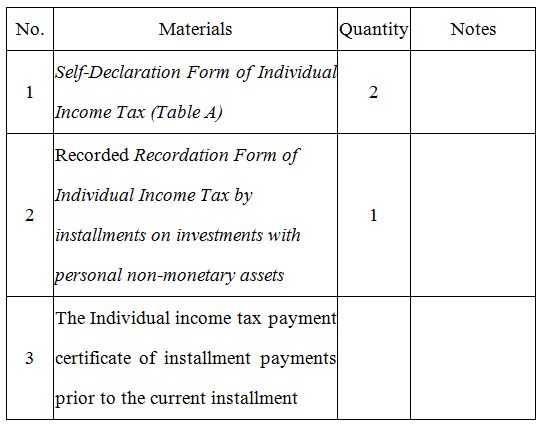

7. Taxpayers who pay IIT by installments on investments with personal non-monetary assets shall submit:

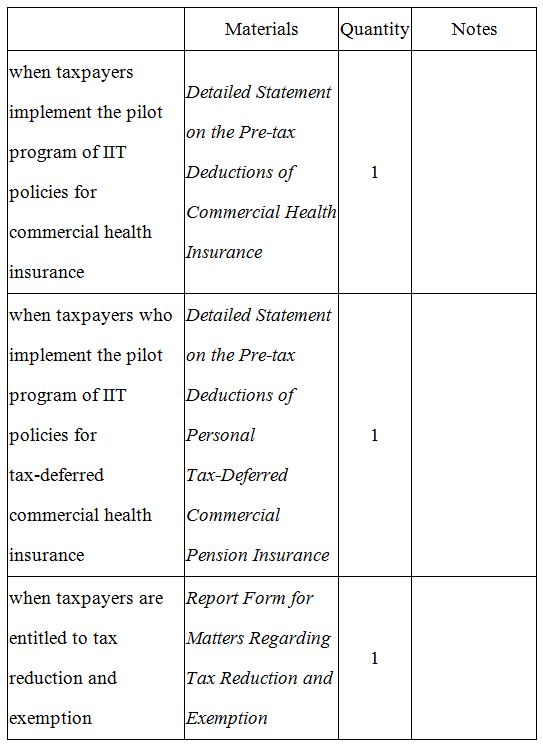

8. Taxpayers under following circumstances shall also submit: